Founded in 2007, Brookmont’s focus is on high-quality value companies that produce compounding cash flows over the long term. They seek to deliver stable outcomes by investing in stable companies prioritizing dividend growth - rooted in strong balance sheets, earnings growth, profitability, and competitive advantages.

Why a Dividend Growth Strategy Makes Sense

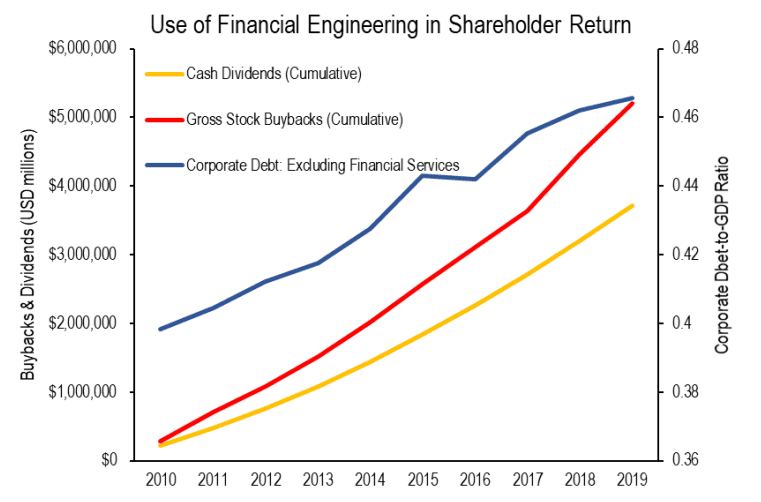

During periods of high inflation, the importance of identifying reliable investments to preserve wealth becomes paramount.

When overall market valuations are historically high, it can be wise to consider investments that offer more than just the promise of future growth.

Studies suggest dividend growth stocks have historically outperformed the market in periods of rising rates.

Focusing on internal correlation and end market exposure rather than broad sector classifications ensures that portfolios have adequate breadth to endure business cycle fluctuations.

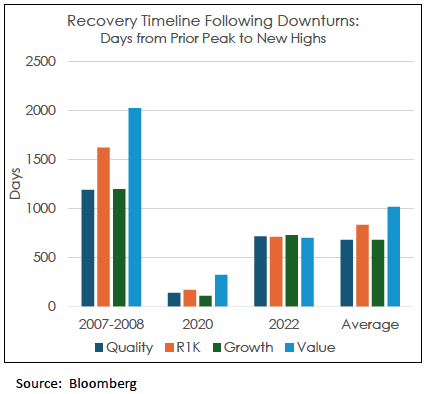

Quality Factor: What Most Allocators Overlook

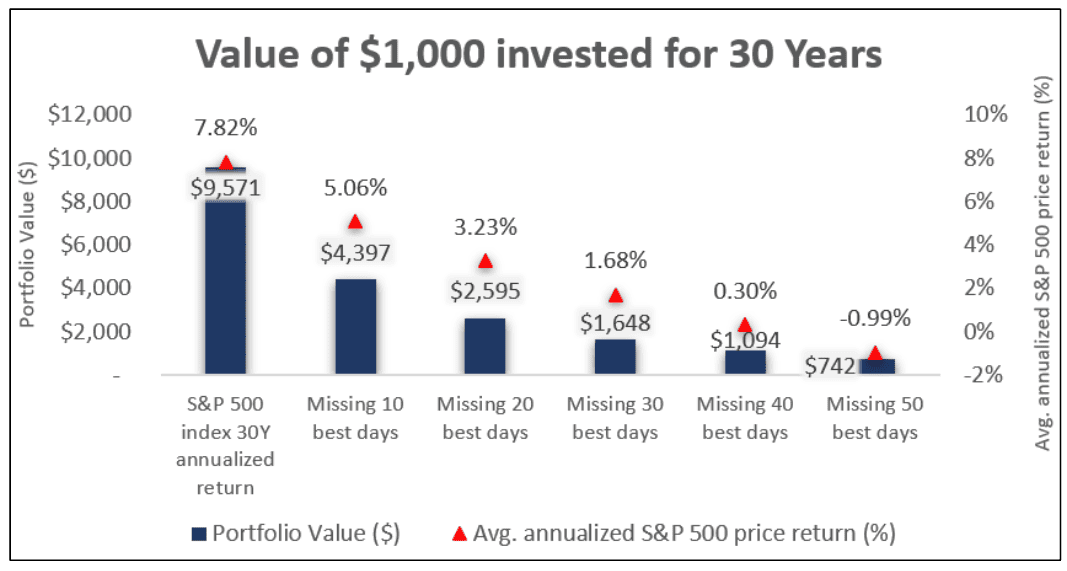

Timing the Market is a Near Impossible Task

By attempting to time the market with a significantly elevated cash position, investors miss these opportunities for gains, which can have a compounding negative effect on performance.